do closed end funds have liquidity risk

Do open-end funds have a fixed number of shares. LiquidityLow Volume higher liquidity risk exists for funds with low volumes.

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

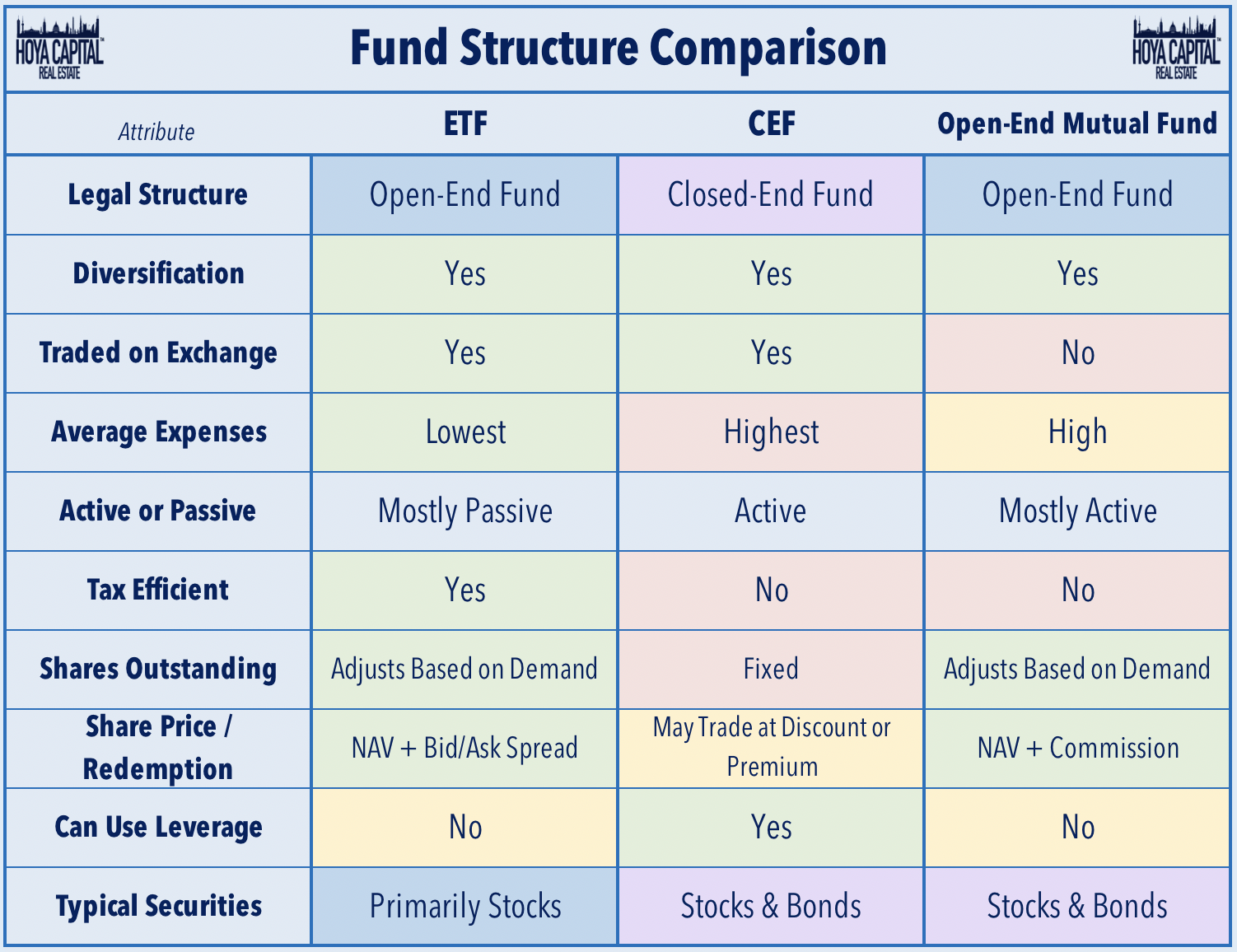

Closed-end funds like open-end mutual funds invest in assets on behalf of their shareholders.

. Unlike open-end funds closed-end funds do not need to maintain liquidity to meet. The classification of the liquidity of each funds portfolio investments into one of four categories based on the. The relative lack of popularity of closed-end funds can be explained by the fact that they are a somewhat complex investment vehicle that tends to be less liquid and more volatile than open-ended.

On June 28 the US Securities and Exchange Commission amended its open-end fund liquidity rule so that funds would not disclose the operation and effectiveness of their liquidity-risk management programs to their clients via the funds annual and semi-annual shareholder reports. Because closed-end funds do not have to purchase or redeem assets in order to facilitate liquidity for fund owners closed-end fund portfolio managers have. Closed-end interval funds are already subject to heightened liquidity standards in order to ensure that they can complete repurchase offers and are required to adopt procedures to ensure that their portfolio assets are sufficiently liquid to comply with their fundamental policies on repurchases as set forth in Rule 23c-3 under the 1940 Act.

It also allows funds to only hold a maximum of 15 of fund assets in illiquid securities. How do closed-end funds pay dividends. Rule 22e-4 also requires principal underwriters and depositors of unit investment trusts UITs to engage in a limited liquidity review.

On the other hand closed end funds have a fixed number of shares. Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the underlying portfolio. On the surface theres a lot to like about closed end funds.

Closed-end funds CEFs can be one solution with yields averaging 673. Closed-end funds CEFs experience larger declines in market liquidity and lower returns than other stocks after the ARS market freeze. New SEC Rule Requires Open-End Funds to Have Formal Liquidity Risk Management Programs.

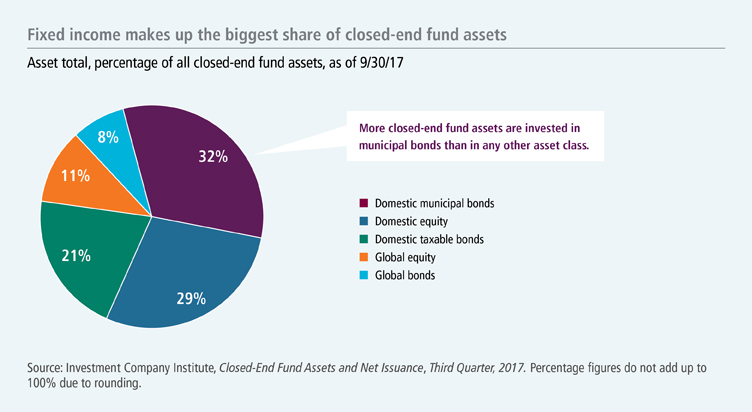

Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility. Initial offering Like a company going public a closed-end fund will have an initial public offering of its shares at which it will sell say 10 million shares for 10 each. Asset classes include stocks US international and sector funds bonds municipal convertible high-yield international and Treasury inflation-protected securities or TIPS a mixture of stocks and bonds balanced funds covered calls preferred stocks real estate investment trusts.

Like mutual funds closed-end funds pay out their earnings to shareholders in two ways. Unlike open-end funds managers are not allowed to create new shares to meet demand from investors. What you dont see in these funds can kill your portfolio though.

The closed-end structure Mark Northway explains provides the manager with the benefit of permanent or long-term committed capital while listing the funds shares allows investors to enjoy liquidity albeit at a premium or discount to net. This can result in. These effects are more pronounced when i ARS-levered CEFs hold a larger fraction of shares outstanding ii CEFs ARS leverage ratio is higher and iii the stocks are ex ante less liquid.

CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the secondary market credit risk concentration risk and discount risk. Their yields range from 632 on average for bond CEFs to. Most closed-end funds make capital gains distributions once each year toward the end of the calendar year.

Since closed-end funds are a much smaller asset class than open-end mutual funds ETFs and stocks some of them have much less trading liquidity. It stipulates that mutual funds have up to seven days to distribute sale proceeds to shareholders although most do it the next business day. In terms of total liquidity buffers some funds reported holding between 2033 in cash and non-cash liquid assets and a few funds reported even between 4496 mainly mixed funds and a few corporate bond funds.

In this video Im revealing the three hidden dangers in closed end funds that destroy wealth. ABOUT CLOSED-END FUNDS Most investors are familiar with mutual funds or open-end registered investment companies. You can get a big discount to the value of the fund and a higher dividend than comparable funds.

Swing Pricing Permitted But Not Required Continued 4 1. We Disagree with Certain Elements. The Investment Company Act of 1940 address two key concerns relating to liquidity risk.

Income dividends pass through to shareholders the interest or dividends collected by the fund net of expenses. In other words it could be harder to buy and sell the stock at desirable prices depending on how many people are willing to take the other side of your trade. Open-end mutual funds typically do not limit the number of shares they can offer and are bought and sold on demand.

The assessment management and periodic review of a funds liquidity risk. If the CEF includes foreign market investments it will be exposed to the typical foreign market risks including currency political and economic risk. Costs the expense ratios are competitive with most open end mutual funds but still higher than index funds and ETFs.

Closed-end funds however. Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says. Registered open-end management investment company including open-end exchange-traded funds ETFs but not including money market funds to establish a liquidity risk management program.

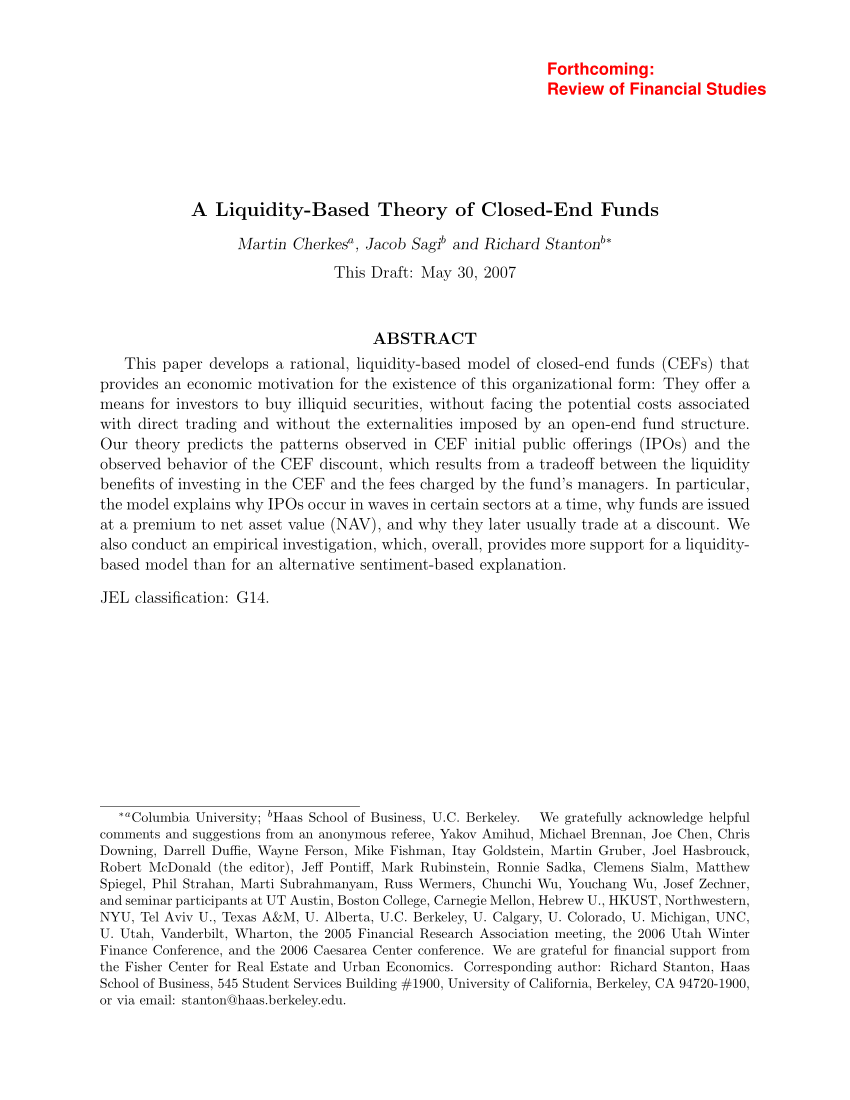

Pdf A Liquidity Based Theory Of Closed End Funds

Closed End Fund Fs Investments

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

What Is The Difference Between Closed And Open Ended Funds Quora

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Pdf A Liquidity Based Theory Of Closed End Funds

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

A Closer Look At Closed End Funds Fundx Insights

Understanding Interval Funds Griffin Capital

Investing In Closed End Funds Nuveen

Closed End Fund Definition Examples How It Works

Pdf A Liquidity Based Theory Of Closed End Funds

Differbetween Difference Between Open Ended And Closed Ended Mutual Funds